The telco has slashed router prices and targets fibre-dark zones to reclaim upcountry ground.

Safaricom has quietly escalated its efforts to counter Starlink by expanding 5G rollout into rural Kenya, the market the satellite internet service provider (ISP) was built to serve. Over the past six months, it has deployed tens of new sites in regions previously off its broadband map. Safaricom’s sales teams are targeting upcountry users with affordable, plug-and-play 5G routers bundled with flexible data plans and branded giveaways like free t-shirts.

At least five customers in Western Kenya told TechCabal that Safaricom salespeople have been in the region since January, pitching the 5G router to them. “They signed me up in two minutes,” said Paminus Osike, a new user in Kenya’s Nyanza province. “Starlink’s initial cost is too high, and I like that this connection isn’t fixed, but I can move around with it.” The sales team that signed him up also sells power banks for KES 5,000 ($39) to help customers stay connected on the move.

Another customer, who runs a small cybercafe business, told TechCabal that he compared Safaricom’s 5G router with a rival device and chose to keep Safaricom’s for its speed and larger data allocation.

Safaricom is trying to reclaim ground where traditional ISPs underdelivered and where Starlink found early momentum. It is a shift from Safaricom’s past urban focus and shows a new push into low-average revenue per user (ARPU) regions.

Starlink launched in Kenya in 2023 to connect areas where fibre and mobile broadband had failed. By late 2024, it was already the country’s seventh-largest ISP, with over 19,000 active subscriptions, mainly in remote counties like parts of the Rift Valley, where broadband coverage remains patchy.

In 2024, Safaricom had proposed regulatory changes targeting satellite providers, arguing that licensing entities without a physical presence left the government with little control. The Communications Authority has not taken up the proposal, so Safaricom is now betting on price and broader access instead.

Starlink’s demand has surged in urban centres instead, despite its pricing model which does not favour cheaper, pay-as-you-go purchases. In Nairobi, it paused new sign-ups due to limited capacity. The network delivers the same bandwidth regardless of population, so busy areas quickly hit performance limits.

In response, Safaricom has doubled fibre speeds and introduced gigabit plans to meet the growing urban demand. It’s positioning itself as a cheaper and more adaptable option in cities where Starlink’s model falls short and in rural areas where Starlink is attempting to thrive.

Price cuts to coincide with rural expansion

In rural Kenya, people do not have disposable cash for internet services. Many are price-sensitive and can’t afford routers, which are seen as a luxury. Safaricom’s strategy of offering low-cost routers and flexible payment options aims to make 5G more accessible to these communities.

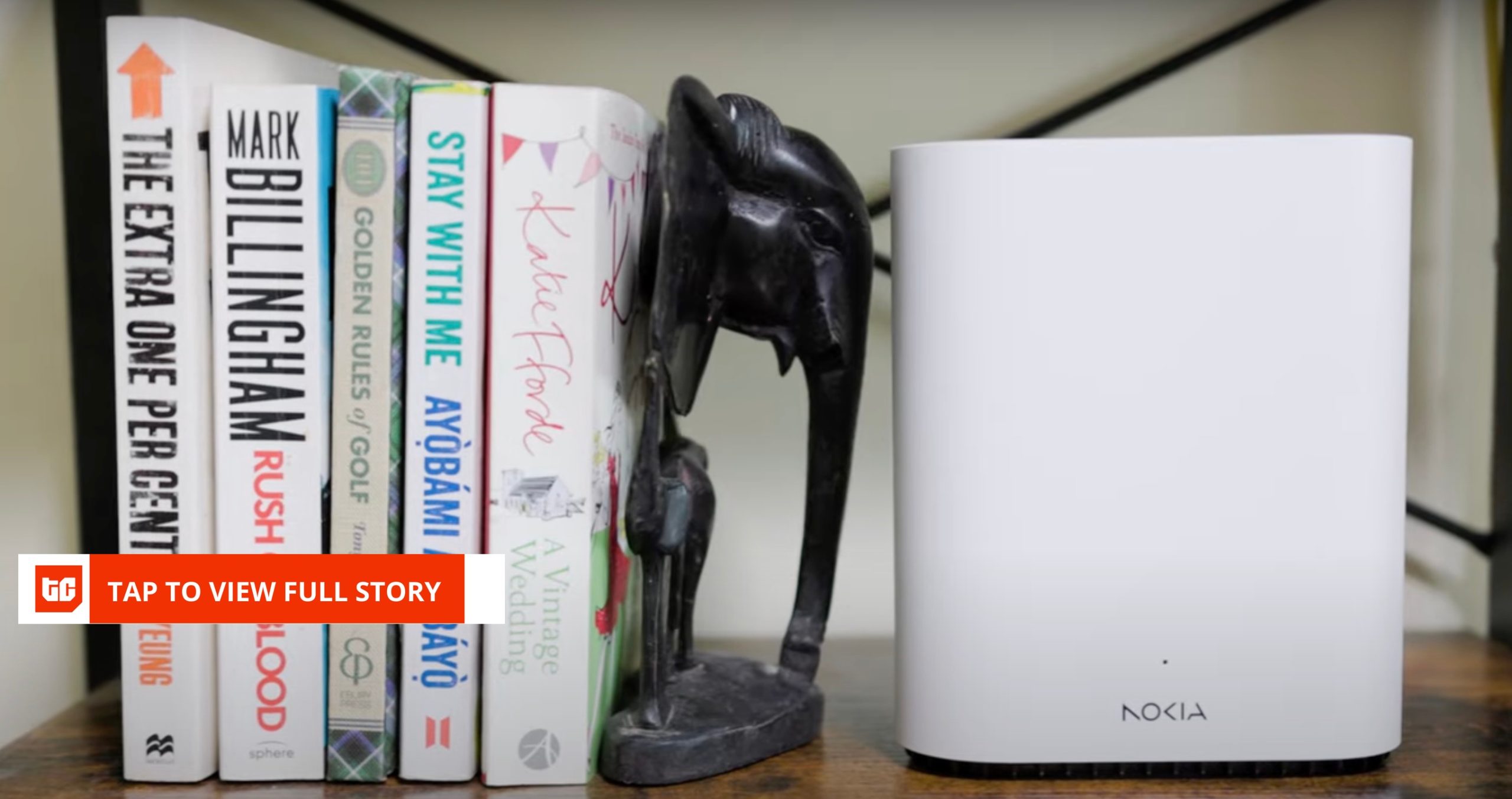

Safaricom’s new 5G offer challenges Starlink on hardware and flexibility. Routers now sell for KES 3,000 ($23), down from KES 25,000 ($192), a huge price drop that coincided with its rural expansion.

The routers fall back to 4G when 5G isn’t available. Some are sold door-to-door, with M-PESA payment options, mirroring sales tactics used by solar home system companies. Monthly plans start at KES 4,000 ($31) for 50 Mbps and go up to KES 10,000 ($77) for 250 Mbps.

Starlink’s basic mini kit costs KES 27,000 ($208), while its standard kit ranges from KES 30,000 to KES 45,000 ($231-$347). Monthly plans remain fixed between KES 1,300 ($10) and KES 6,500 ($50), depending on tier. Roaming and mounting requirements add to the cost and limit flexibility.

Safaricom is stepping up its rollout instead of waiting to see what Starlink does. It’s actively building out 5G, lowering costs, and using familiar mobile infrastructure to reach more users. While Starlink works on ground stations to ease congestion, Safaricom offers a practical, locally available alternative.

The telco declined to disclose how many customers use its 5G routers.

Telcos are shifting in Africa

Telcos across Africa are pushing back against Starlink’s low-cost entry model. In Zimbabwe, Nigeria and Cameroon, operators accuse it of unfair competition for skipping the heavy investment in cables and towers. In Zimbabwe, Liquid Home has had to cut prices, TelOne has teamed up with OneWeb, and in Nigeria, Starlink has become the third-largest ISP in under two years.

Safaricom is using its mobile network to promote 5G as a real Starlink challenger in Kenya, especially in underserved areas. It now has 1,114 5G sites across 102 towns, reaching all 47 counties and covering about 14% of the population. Over 780,000 5G smartphones are active, and more than 11,000 enterprise clients use its 5G services.

Crédito: Link de origem