The IMF has significantly downgraded its projections for global growth in the wake of major trade policy shifts and the world economy is now facing a “major test” says the managing director of the IMF.

Speaking to the press at the IMF/World Bank Spring Meetings in Washington DC, Kristalina Georgieva said countries have been put in a difficult situation because economic safeguards have been depleted by the shocks of recent years.

In a downbeat World Economic Outlook earlier this week, the IMF projected that global growth will drop to 2.8% in 2025 and 3% in 2026 due to the announcement of “a series of new tariff measures by the United States and countermeasures by its trading partners.”

The difficult backdrop, Georgieva told the press, has created urgency for action requiring countries to strengthen their economies in a world of rapid change.

Three recommendations

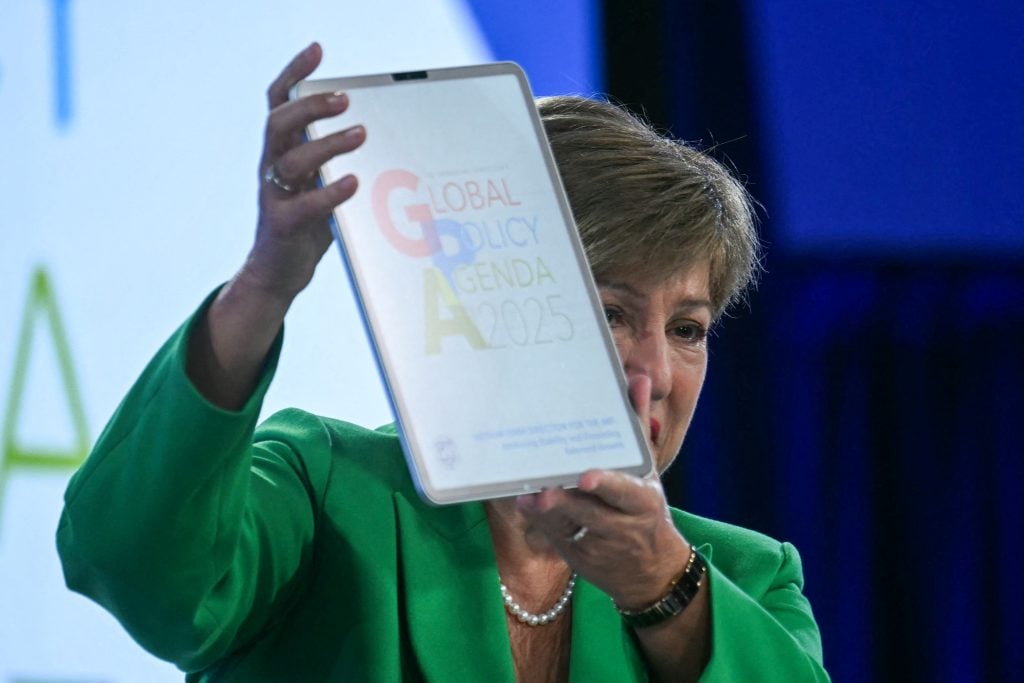

Georgieva said the IMF has outlined in their Global Policy Agenda document what she called three overarching priorities that member states should address to navigate the turmoil.

First, countries should work constructively to resolve trade tensions as swiftly as possible in order to bring certainty because uncertainty weakens prospects for growth.

She advised countries like China to “boost private consumption and embrace a shift to services” while urging the US to reduce fiscal deficits.

She suggested the Euro area should speed up work on the single market and called on other countries “to lower their trade barriers. Both tariff and non tariff.”

“The current conjuncture with elevated uncertainty puts a premium on safeguarding macroeconomic and financial stability.

Sudden shifts in trade flows, an abrupt repricing of financial assets, or disorderly exchange rate adjustments could undermine macroeconomic and financial stability.

“Another financial crisis would be devastating for the world, its people, and their livelihoods. Growth could stall for years as debt escalates, with potentially destabilising spillovers to other countries. The current environment thus demands building resilience and buffers, as well as agile policies to mitigate shocks,” the document says.

Her second priority stressed the need for countries to “safeguard their economic and financial stability”

She said doing this will entail getting things right in the area of fiscal policy by rebuilding buffers that help absorb shocks.

Speaking on the role of central banks in achieving this, she noted that aside from working to support growth and contain inflation, central banks must maintain their independence which she said is critical for credibility.

“Central banks must deliver on low and stable inflation, and their independence must be preserved. Supervisory agencies must safeguard financial sector stability by maintaining robust regulation and supervision and enhancing the monitoring of vulnerabilities in nonbanks,” the document states.

She described her third priority as doubling down on growth oriented reforms to lift productivity.

She called on countries to initiate long needed and often delayed reforms that would put entrepreneurship in the front seat, reform labour markets, create conditions for innovation and take advantage of technological advances.

“Domestic reforms are urgently needed to enable private sector-led economic transformation, especially since trade could become a less reliable source of growth. Policymakers should improve the business environment, streamline excessive regulation, fight corruption, and foster innovation and technology adoption to drive productivity,” the Fund said.

Crédito: Link de origem