Two months after CryptoBridge eXchange (CBEX), the Ponzi scheme which falsely claimed to be a cryptocurrency exchange platform, froze withdrawals for thousands of customers on its platform, it is back with another gimmick, much to the chagrin of regulators.

CBEX never shut down its platform, despite warnings from Nigeria’s Securities and Exchange Commission (SEC) and multiple public arrest warrants issued by the Economic and Financial Crimes Commission (EFCC) for several persons linked to the Ponzi scheme.

The platform has been operating under different domains, making it difficult for authorities to track its activities. CBEX is now asking users to pay a $100 “verification fee” to enable them to withdraw their frozen balances, according to messages shared on engagement groups seen by TechCabal. Once they do, these users get access to “sub-accounts” which allow them to continue their daily trading activities as they’re instructed on the platform.

“The verification fee is now $100 for all unverified accounts, regardless of your balance,” CBEX said in one of those messages. This is a deviation from its previous method, where it asked users to pay $100 for balances below $1,000 and $200 for balances above $1,000.

According to updates seen by TechCabal, withdrawals will be sorted out in batches and are contingent upon users completing their assigned daily trading activities. CBEX claims it will process 50% of all pending user withdrawals by June 25 and the remaining 50% by August 25. It also says 30% of profits from users’ trading activities will be paid out under a revenue-sharing model on October 25.

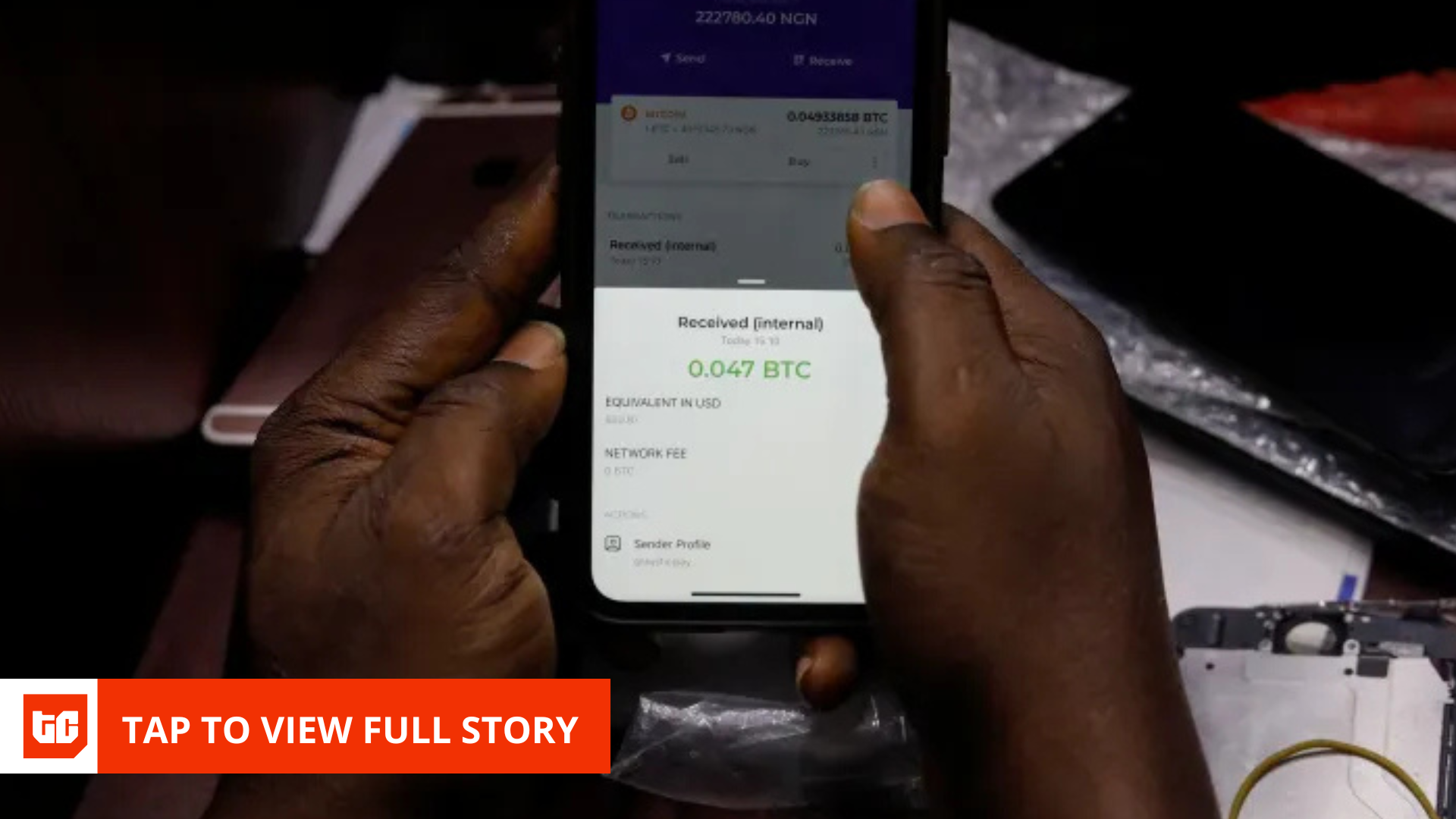

Nigerians, desperate to get back their money, have begun paying the verification fee. After payment, they gain access to a dashboard showing their frozen balance as of April. Their balance begins to grow again once they engage in activities that generate revenue, such as referring new users or trading using CBEX’s daily signals. The signals are codes shared manually on CBEX engagement groups; users copy them at specific times when they’re released and paste them in their apps.

Regulators are alert to the issue. On June 11, the SEC issued another warning, cautioning Nigerians to refrain from investing money in CBEX.

“The Commission hereby restates unequivocally that neither CBEX nor ST Technologies International Limited or Smart Treasure/Super Technology [CBEX’s partner] is registered with the Commission, or authorised to offer investment-related services to the Nigerian public,” SEC wrote in the public statement.

The EFCC has listed six Nigerians in connection with the platform, declaring them wanted. Several media publications also reported that the anti-graft agency recovered part of the stolen funds on May 26. However, Nigerians who were hopeful of the EFCC’s progress at the time, now left to hang dry, are taking matters into their own hands.

Nigerians still believe in CBEX

In one of the Telegram groups connected to ST Technologies, a CBEX partner, several Nigerians are already making payments and referring friends to the platform.

Old users are hurrying to pay the verification fee against a June 24 deadline. They are also roping in new entrants who are making USDT transfers exceeding thousands of dollars to join CBEX.

“Depositing $100 is the only way to verify your account,” wrote an ST admin, who only identified as Laurafx Wilson in one of the groups.

A CBEX user on Telegram claimed that he was paid by the platform after he verified his account. However, they declined to share proof of this payment when TechCabal reached out. CBEX still maintains it will clear 50% of all delayed payments on June 25.

The risk in keeping the faith in CBEX

While many Nigerians are shuffling back to CBEX to recover their money—and try to earn some more while they’re at it—others are cautious.

“Why can’t they charge the $100 on our balance and allow us back into the platform?” said Favour Kwaghgande, a CBEX user whose account got frozen in April. “That was my school fees I invested, and honestly, I have no idea where to raise another $100 to redeem my account.”

CBEX representatives have claimed that the verification fee is necessary to filter “fraudsters” and “illegal arbitrageurs” hidden among their members. The logic here is that if the platform remains free, fraudsters could exploit the system to create multiple fake accounts and siphon unearned money.

Arbitrageurs, on the other hand, could be using CBEX only to exploit price differences, buying cryptocurrencies low and selling high on other platforms. Therefore, the platform wants to keep these sets of users locked out.

Yet, it could just be a convenient ruse for CBEX to appear credible and collect more money from desperate users. By placing a fee on withdrawal, CBEX is dangling an apple in the faces of helpless Nigerians who are already taking the bait.

“[CBEX] is most likely fetching prices from an oracle,” said Adebayo Solomon, a Nigerian blockchain engineer. “The price differences [on its app] could vary slightly from other places, but most times, it is almost negligible. If they’re truly worried about people gaming the system, they could use a decentralised authentication solution like zkpass to ensure it’s one account per user, but they’re not doing that.”

It is also baffling that Ponzi schemes like CBEX remain in operation, with several others joining the fold. Tofro and FutCoreCoin—two platforms with similar operations as CBEX—are coming up, and they’re marketing themselves to the circle of users that invested in CBEX.

While the SEC has become more proactive in issuing warnings about these platforms through circulars, it may need to intensify efforts to cut these operations at the head. As far as consumer protection goes, the regulator has the authority to shut down non-compliant securities exchange platforms, and perhaps needs to, to protect Nigerians from themselves.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com

Crédito: Link de origem