Key Points

- Indimi’s son, Mustafa, supports Oriental Energy in court, denying sisters’ $420 million dividend claim and affirming shares were legally bought for $10 million.

- Legal feud escalates with two parallel lawsuits over dividends; sisters claim they’re owed $43.5 million amid delays in court proceedings.

- Oriental Energy unveils new FPSO vessel for Okwok Field, targeting 30,000 barrels/day by mid-2025 to boost production and revenues.

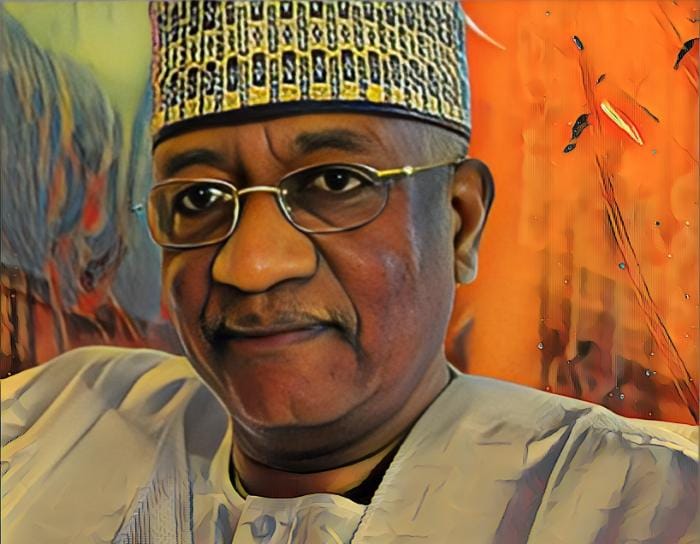

More than two months after Nigerian oil billionaire Mohammed Indimi addressed a $435 million dividend dispute, disclosing he paid his daughters $10 million for their shares in Oriental Energy, tensions within the family have only deepened. His eldest son, Mustafa Indimi, has now filed an affidavit against his sisters, Ameena and Zara, reigniting the legal battle over dividends tied to the family’s prized oil company.

Mustafa backs firm amid legal battle

Mustafa, the managing director of Oriental Energy, is siding with his father and defending the company. In a sworn statement, he pushes back against his sisters’ claims that they were denied $420 million in dividends, including a $42 million portion they believe is rightfully theirs. This latest action follows an earlier lawsuit from the sisters, who initially alleged they were owed $435 million, raising questions about how the figures overlap across both cases.

In his affidavit, Mustafa firmly denies their allegations. He supports the company’s stance that no such $420 million dividend was ever declared, and disputes their assertion that they were pressured into giving up their shares. According to his statement, Indimi legally acquired over 98 percent of his daughters’ shares in exchange for a $10 million payment. Mustafa also confirmed that emails authorizing those payments came directly from their father. But as the courtroom fight drags on, attention is now turning to how the legal process itself is unfolding.

Sisters seek $43.5 million dividend

The sisters’ case, filed in 2022, landed with Justice Evelyn Maha at the Federal High Court in Abuja. However, in 2024, she was transferred to another state before the defense could present its full argument. Instead of reassigning the case, as is standard practice, the Chief Judge granted her special permission to keep handling it. Since then, she has been commuting to Abuja for hearings, which has led to significant delays.

Frustrated by the slow pace, the sisters filed a second lawsuit last year before another judge in Abuja, Justice Emeka Nwite. This version of the case claims the dividend amount is $435 million—slightly higher than their earlier figure—and says they are owed $43.5 million. As a result, two nearly identical cases are now playing out in parallel courts, complicating an already tangled family dispute.

New FPSO to boost production capacity

Founded in 1990, Oriental Energy is a privately held Nigerian oil firm and the cornerstone of Indimi’s fortune. The company operates three key offshore assets in the Niger Delta: the Ebok Field, Okwok Field, and OML 115. Its Ebok Terminal also plays a vital role in storing and exporting crude oil.

Indimi’s estimated net worth dipped from $670 million in 2014 to $500 million the following year, prompting Forbes to stop tracking his wealth. But despite that decline, he remains a major figure in Nigerian business circles, with additional investments including a significant stake in Jaiz Bank. While his personal fortune may have taken a hit, Oriental Energy still holds assets worth billions, highlighting the financial and emotional weight behind this family feud.

Even as the legal fight plays out, Indimi hasn’t taken his foot off the gas when it comes to business. In December 2024, he unveiled a new Floating Production Storage and Offloading (FPSO) vessel capable of holding up to one million barrels of oil. Slated for deployment to the Okwok Oil Field, production is expected to start at 17,000 barrels per day, ramping up to 30,000. The vessel is scheduled to leave Dubai in early 2025 and begin operations by midyear—potentially giving both Oriental Energy and Nigeria’s oil revenues a timely boost.

Crédito: Link de origem